The Global Environment Facility (GEF) plays a crucial role in leveraging cofinancing to enhance project impact, sustainability, and partnerships.

Since its inception, GEF has disbursed $24 billion in grants and secured an impressive $138 billion in cofinancing commitments, highlighting its commitment to maximizing resources for environmental initiatives.

Under my leadership, and in collaboration with Mariana Cerbon, Aneesh Kotru, and Jeneen Garcia, the evaluation team from the GEF Independent Evaluation Office (IEO) conducted an Evaluation of Cofinancing in the GEF. Our evaluation examined the definition, targets, factors influencing commitments, sources and forms, realization during implementation, and the impact of cofinancing across GEF projects.

GEF's Cofinancing Commitments in Context

Our first step was to compare GEF's cofinancing commitments to those of other organizations. GEF's targeted ratio of 7:1—$7 in cofinancing per $1 of GEF funding— surpasses its comparators. This success stems in part from GEF’s broad definition of cofinancing and its flexible approach in accepting a wide variety of contributions. Our evaluation also revealed patterns in cofinancing across projects.

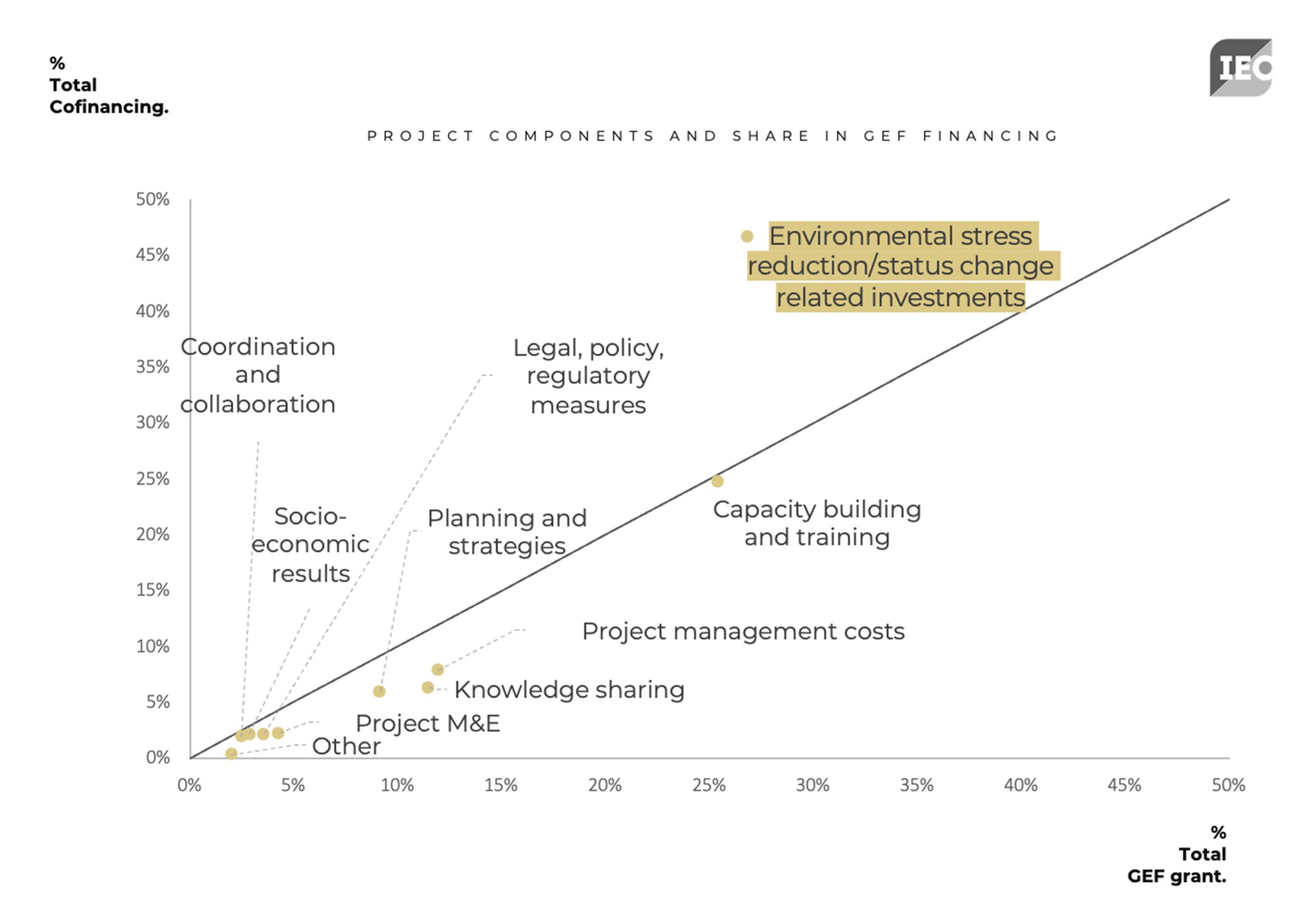

Projects addressing climate change, involving multilateral development banks, implemented in upper-middle-income countries, tend to attract higher cofinancing.

Investments in infrastructure, technology demonstration, and efficient equipment procurement also bring in more cofinancing. Similarly, projects that support mature technologies, generate revenue, and engage the private sector excel in attracting funds. In contrast, activities focused on capacity building, legal and policy development, and project monitoring attract less cofinancing and therefore need more support from the GEF.

Sources and Forms of Cofinancing

Understanding who contributes cofinancing and in what form was another key focus. Data shows that recipient country governments are the largest source, accounting for 47% of total cofinancing commitment. GEF Agencies contribute 22%, and the private sector provides 12%.

Significant portions of cofinancing come as grants (30%), in-kind support (25%), and loans (24%). Projects implemented by multilateral development banks (MDBs) often combine GEF financing with loans, making up 55% of their cofinancing. Conversely, UN Agencies, which rely heavily on external sources, secure a higher proportion of cofinancing through grants (39%) and in-kind support (33%) with only 10% in loans.

Ensuring Quality Cofinancing

We examined the GEF Secretariat's approach to ensuring adequate and high-quality cofinancing for GEF activities. Cofinancing is a critical factor in project appraisals, influencing approval decisions. During GEF-7 and GEF-8, 20% of the 74 project proposals rejected cited cofinancing as a reason. GEF program managers generally show flexibility in assessing cofinancing levels and types, providing feedback for adjustments and sometimes requesting higher ratios.

They generally prefer cofinancing that supports non-recurrent expenditures but are also accepting of in-kind cofinancing for projects where traditional cofinancing is challenging to secure.

However, while cofinancing commitments are rigorously scrutinized during appraisal, less attention is given to monitoring their realization during implementation.

This oversight leads to challenges in data completeness and quality, particularly concerning newly-secured cofinancing contributions.

Realizing Cofinancing During Implementation

We analyzed how well cofinancing commitments are fulfilled during project implementation. Interestingly, 34% of the original cofinancing commitments fall through during this phase. Loans, in particular, struggle with realization, with only 45% being fully or partially fulfilled, often due to shifts in national priorities and project delays.

While gaps from unrealized cofinancing are generally mitigated by tapping into new sources, there are differences among agencies. UN Agencies and International NGOs actively pursue new cofinancing sources during implementation, unlike MDBs, which tend not to.

Consequently, gaps left by unrealized cofinancing in MDB-implemented projects are often not fully covered, unlike those by UN Agencies and International NGOs.

Impact of Cofinancing on Project Outcomes

We explored the influence of cofinancing on project outcomes. A high cofinancing ratio doesn't guarantee better project success rates. However, projects where cofinancing commitments are fully realized tend to perform better and have a higher likelihood of sustainability. On average, projects that fully realize cofinancing commitments receive ratings that are 0.10 points higher for outcomes, and 0.23 points higher for the likelihood of sustainability, on a binary scale.

Our qualitative analysis confirms a positive link between cofinancing realization and project outcomes. However, inclusion of non-essential contributions as cofinancing and reporting gaps can obscure this relationship.

Looking Ahead

Our evaluation highlights areas for improvement.

Not all cofinancing is equally impactful—some is crucial for GEF goals, while others are loosely linked to GEF activities.

GEF should focus more on the quality of cofinancing, considering factors like timing, feasibility of realization, and synergy with funded activities. Improved reporting on cofinancing realization, especially for new contributions secured post-project approval, is vital. Addressing these issues will strengthen GEF's ability to secure cofinancing that complements its investments and enhances its environmental impact.

Disclaimer: The blog presents the views of the authors and does not necessarily reflect the official position of the GEF IEO.